Whole life insurance, a staple in the financial and insurance industries, is a type of permanent life insurance that provides lifelong coverage and includes a savings component known as the cash value. This product has gained traction for its combination of insurance and investment features, offering policyholders a range of benefits. Let’s delve into the various advantages that whole life insurance can offer to policyholders.

What is Whole Life Insurance?

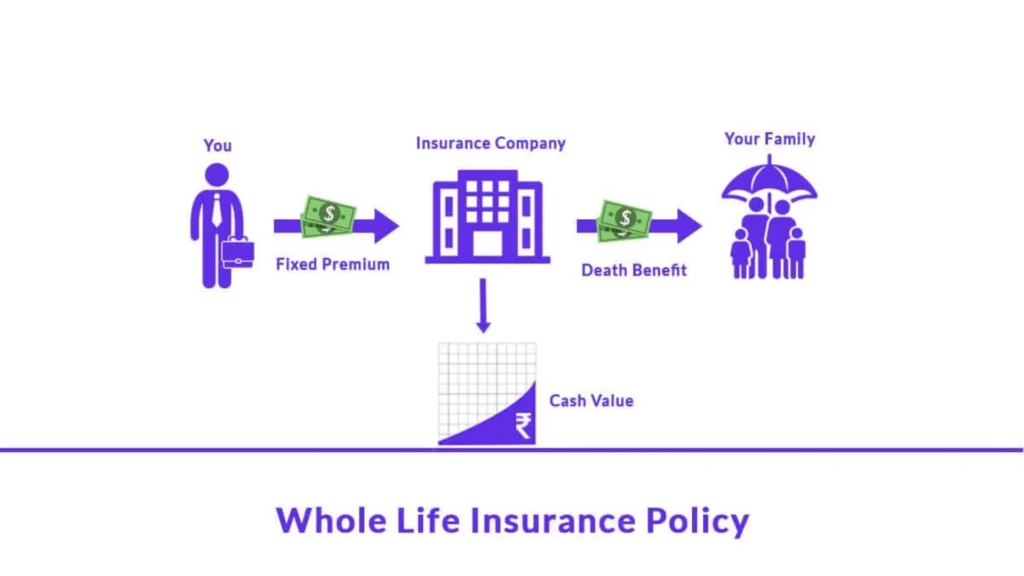

Whole life insurance is a type of life insurance policy that provides coverage for the insured’s entire life, as long as premiums are paid. Unlike term life insurance, which covers the policyholder for a specified period, whole life insurance guarantees a death benefit for the beneficiaries regardless of when the insured passes away. In addition to the death benefit, whole life insurance policies accumulate cash value over time, which can be accessed or borrowed against by the policyholder.

Key Benefits of Whole Life Insurance

Whole life insurance offers a host of benefits that make it an attractive option for those seeking long-term financial security. Here are some of the key advantages:

Lifetime Coverage

One of the most significant benefits of whole life insurance is the guarantee of lifetime coverage. This means that as long as the policyholder continues to pay the premiums, their beneficiaries are assured of receiving the death benefit whenever the policyholder passes away. This contrasts with term life insurance, which only provides coverage for a specific period. Lifetime coverage provides peace of mind, knowing that the policyholder’s loved ones will be financially protected regardless of when they die.

Cash Value Accumulation

Whole life insurance policies come with a cash value component, which is essentially a savings account within the policy. A portion of the premium payments goes towards building this cash value, which grows over time on a tax-deferred basis. This feature provides policyholders with a financial asset that they can access during their lifetime.

- Tax-Deferred Growth: The cash value grows on a tax-deferred basis, meaning policyholders do not pay taxes on the gains each year. This allows the cash value to compound more effectively over time.

- Policy Loans: Policyholders can borrow against the cash value of their policy. This can be particularly beneficial in times of financial need, as the loan interest rates are typically lower than those of traditional loans. Plus, there is no requirement to repay these loans immediately, though the outstanding amount will be deducted from the death benefit if not repaid.

- Surrender Value: If the policyholder decides to terminate the policy, they can receive the cash value, less any surrender charges. This provides a form of liquidity and financial flexibility.

Dividend Payments

Many whole life insurance policies from mutual insurance companies offer the potential for dividend payments. These dividends are a share of the insurer’s profits distributed to policyholders and can be used in several ways:

- Cash: Dividends can be taken as cash payments.

- Premium Reduction: They can be applied to reduce future premium payments.

- Paid-Up Additions: Dividends can be used to purchase additional coverage, increasing the policy’s death benefit and cash value.

- Savings Accumulation: They can be left to accumulate at interest within the policy.

Dividends are not guaranteed but can significantly enhance the value of a whole life policy over time.

Tax Advantages

Whole life insurance offers several tax benefits that can make it an attractive part of a financial strategy:

- Tax-Free Death Benefit: The death benefit paid to beneficiaries is generally income tax-free, providing significant financial support without a tax burden.

- Tax-Deferred Growth: As mentioned earlier, the cash value grows on a tax-deferred basis, allowing for more efficient compounding.

- Tax-Advantaged Access: Loans taken against the policy’s cash value are generally not taxable as long as the policy remains in force.

These tax advantages can help in estate planning and wealth transfer, ensuring that beneficiaries receive the maximum benefit with minimal tax implications.

Estate Planning and Wealth Transfer

Whole life insurance can play a crucial role in estate planning and wealth transfer strategies. For high-net-worth individuals, whole life insurance provides a means to pass on wealth efficiently while minimizing estate taxes. The tax-free death benefit can be used to cover estate taxes, ensuring that heirs receive the full value of the estate. Additionally, whole life insurance can help equalize inheritances among heirs, providing liquidity to pay off debts or fund trusts.

Stable Premiums

Whole life insurance policies feature stable, fixed premiums that do not increase over time. This is particularly advantageous for policyholders who want predictable, consistent payments throughout their lives. Unlike term insurance, where premiums can increase significantly upon renewal, whole life insurance premiums remain level, making long-term financial planning easier.

Forced Savings Mechanism

The cash value component of whole life insurance acts as a forced savings mechanism. By requiring regular premium payments that contribute to the cash value, policyholders build a financial asset over time. This can be beneficial for those who may struggle to save money independently. The cash value grows steadily and can serve as a source of funds for future needs, such as retirement, education expenses, or emergencies.

Financial Security and Peace of Mind

One of the most compelling benefits of whole life insurance is the financial security and peace of mind it provides. Knowing that loved ones will be taken care of financially, regardless of when the policyholder passes away, can be a tremendous relief. Additionally, the policy’s cash value can provide a financial cushion during the policyholder’s lifetime, offering stability and flexibility in the face of life’s uncertainties.

Considerations When Choosing Whole Life Insurance

While whole life insurance offers numerous benefits, it’s essential to consider whether it aligns with your financial goals and needs. Here are some factors to keep in mind:

Higher Premiums

Whole life insurance typically comes with higher premiums compared to term life insurance. This is because it combines a death benefit with a savings component. While the higher cost is offset by the policy’s additional benefits, it’s crucial to ensure that the premiums fit within your budget. For those primarily seeking coverage for a specific period, term life insurance may be a more cost-effective option.

Long-Term Commitment

Whole life insurance requires a long-term commitment. To fully benefit from the policy’s features, such as cash value accumulation and stable premiums, policyholders must be prepared to maintain the policy for many years. Surrendering the policy early can result in significant financial loss due to surrender charges and the potential loss of accumulated cash value.

Complexity

Whole life insurance can be more complex than other types of life insurance. Understanding the policy’s various components, such as cash value, dividends, and loan provisions, can be challenging. It’s essential to work with a knowledgeable insurance advisor who can help you navigate these complexities and tailor the policy to your specific needs.

Potential for Over-Insurance

Given its comprehensive nature, there is a risk of purchasing more insurance than necessary with whole life insurance. It’s essential to assess your financial situation and insurance needs carefully. For some individuals, a combination of term life insurance and other investment vehicles may provide more flexibility and cost-efficiency.

How Whole Life Insurance Fits into a Financial Plan

Whole life insurance can be a valuable component of a comprehensive financial plan. Here’s how it can integrate with other financial strategies:

Retirement Planning

Whole life insurance can complement retirement planning by providing a source of tax-advantaged funds. The policy’s cash value can be accessed through loans or withdrawals during retirement, supplementing other retirement income sources. This can be particularly useful in managing tax liabilities and ensuring a stable income stream in retirement.

Education Funding

The cash value in a whole life insurance policy can be used to fund education expenses for children or grandchildren. This provides an alternative to traditional education savings plans and can be a flexible source of funds for educational needs.

Business Planning

For business owners, whole life insurance can serve multiple purposes. It can provide funds for business continuation or succession planning, ensuring that the business remains operational after the owner’s death. Additionally, the policy can be used as collateral for business loans or to fund buy-sell agreements.

Legacy Planning

Whole life insurance is an effective tool for legacy planning. The death benefit can be used to create a lasting financial legacy for heirs or charitable organizations. Policyholders can also use the cash value to establish trusts or other estate planning structures, providing long-term benefits to their beneficiaries.

Comparing Whole Life Insurance with Other Types of Insurance

To fully appreciate the benefits of whole life insurance, it’s helpful to compare it with other types of life insurance:

Term Life Insurance

- Coverage Period: Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. Whole life insurance offers lifelong coverage.

- Premiums: Term life insurance premiums are generally lower initially but can increase significantly upon renewal. Whole life insurance has higher, fixed premiums.

- Cash Value: Term life insurance does not build cash value. Whole life insurance accumulates cash value over time.

Universal Life Insurance

- Flexibility: Universal life insurance offers more flexibility in premium payments and death benefits compared to whole life insurance.

- Investment Options: Universal life insurance policies often allow policyholders to allocate their cash value to various investment options, potentially leading to higher returns but also increased risk.

- Cash Value: Both universal and whole life insurance accumulate cash value, but the growth and risk profiles differ.

Variable Life Insurance

- Investment Component: Variable life insurance allows policyholders to invest the cash value in a range of investment options,